We’ve said it before and we’ll say it again, Adelaide is a very steady market when it comes to real estate. Core Logic recently released their March report and the old story is ringing true once again, which is great news for homeowners and investors with property in South Australia.

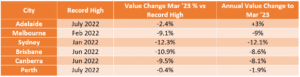

Both Melbourne and Sydney hit their record high values in Q1 of the 2022 calendar year while Adelaide, Brisbane, Canberra and Perth lagged somewhat, hitting their record highs in June or July 2022.  We could assume that the drop in values in the “lagging” states is still to come however, our experience tells us that market corrections in Adelaide are likely to be softer than those in other cities. We simply do not experience the quantum of swings we see in Sydney and Melbourne.

We could assume that the drop in values in the “lagging” states is still to come however, our experience tells us that market corrections in Adelaide are likely to be softer than those in other cities. We simply do not experience the quantum of swings we see in Sydney and Melbourne.

This cycle though, Brisbane and Canberra have experienced value reductions close to those in Sydney and Melbourne even though their record highs didn’t happen until June ’22. So, it is reasonable for us to conclude that the timing of the record high is not material in explaining the softer landing for Adelaide.

All major cities are seeing a reduction in the number of dwelling sales compared with last year. Adelaide sales are down 6.7% year on year while Sydney, Melbourne and Brisbane sales are down more than 20% compared with March last year. This suggests that in Adelaide, while there is obviously some reduction in selling activity, sellers are still putting properties on the market and those properties are only taking on average an additional 2 days to sell (36 days in March ’23 vs 34 days in March ’22). So, not much to see there. Days to sell are consistently in the 30s across the major cities, with the exception being Canberra where the average for March ‘23 was 50 days.

Since February ‘23, the auction clearance rate in Adelaide has averaged more than 70% each week which also compares favourably to other cities. Total listings (properties on the market in Adelaide as opposed to sales) were 5.9% lower in March ’23 vs March ’22.

For now, the RBA cash rate is holding at 3.6% and this provides some relief for homeowners who purchased during a climate of low interest rates. As rates have been increasing, these owners have had to absorb the resulting increases in repayments and no doubt this has had a negative impact on their discretionary spending.

The rental market is very tight Australia-wide and Adelaide has seen an 11.5% annual increase in rents. This, coupled with other inflationary pressures such as increasing utility and food prices means that households are under increasing pressure to make ends meet if wages growth doesn’t compensate. Investors are unlikely to be keen to absorb recent and future interest rate increases and we expect that rental inflation will continue as repayment increases are passed onto tenants.

The next few months will be very interesting indeed. Properties listed for sale tend to decline during the late Autumn and Winter months, coming out of hibernation as Spring approaches. Having said that, the last two years have not been typical and like all other patterns in Australian real estate, the Spring uplift tends to be less pronounced in South Australia. We’re just a little bit different here….