The conclusion of the Spring sale season marks another interesting moment in South Australia’s real estate history. Over the decade leading up to 2020, the state witnessed an annual average of approximately 46,000 property transfers. However, the years 2021 and 2022 saw this number soar to an average of over 62,000, driven by a dynamic market and almost a mad scramble to invest, trade up and in some cases take on a sea or tree change. Yet, the latest data for the 11 months to November 2023 paints a different picture, with just 47,914 transactions so far, suggesting a shift towards what might be a new transaction number norm in the market and one that is much lower than 2021 and 2022. If December 2023 property transfer numbers meet the average of 4,500 we have seen over the past 15 years, 2023 will edge just a little ahead of 2020 and nowhere near the glory years of 2021 and 2022.

Calendar year transfers recorded by Land Services SA

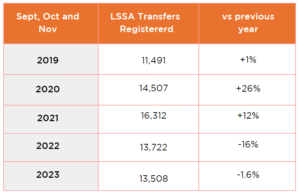

A deeper dive into the months of September, October, and November over the past few years reveals an intriguing trend. Post-2020, the real estate market experienced a significant boom, with transaction numbers peaking in 2021. However, there’s been a noticeable deceleration in 2022 and 2023, hinting at a market recalibration.

Looking at Land Services SA (LSSA) transfers registered during these spring months, we observe a fluctuating pattern over the past 5 years:

These figures underscore a key learning from the COVID era: the real estate market in South Australia is not predictable and not immune to national trends. The pandemic significantly influenced market dynamics, sparked by developments like remote working, an urban exodus, the pursuit of lifestyle changes, and a rise in well-funded buyers due to travel restrictions. As the world returns to normalcy, with travel resuming and interest rates climbing from their historic lows, the definition of ‘normal’ in real estate becomes ever more elusive.

This leads us to ponder the implications for property values. As 2022 concluded, there was an anticipation of a cooling in the South Australian residential property market following remarkable growth. Indeed, while Greater Adelaide’s median property values rose by 13.4% in the 12-month period to November 2022, this rate slowed to 7.6% for the same period in 2023. In comparison, Sydney and Melbourne saw growth of 10.2% and 3%, respectively in 2023, a reversal from their previous year’s contractions. As of November 2023, Adelaide’s median dwelling value stood at $704,267.

From the lowest point during COVID to the peak in August 2022, Adelaide’s property values surged by 41.1%. However, from that peak to the trough in March 2023, there has been only a modest decline of -1.7%, the lowest among the major markets, excepting Perth which dropped just -0.6%. This reaffirms that value corrections in South Australia are typically moderate, offering stability for both owner-occupiers and investors. We await 2024 with great interest.