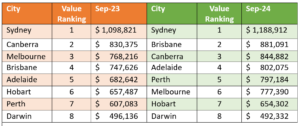

The Australian property market is constantly evolving, and the past year has been no exception. While we may have expected Sydney to continue dominating the rankings, the shifts across other cities demonstrate how dynamic the Australian market can be. Property values are influenced by a multitude of factors, such as supply and demand, interest rates, and population growth, leading to noticeable changes in median property prices across the nation.

In September 2023, the rankings showed a mix of both traditional housing powerhouses like Sydney and Melbourne with perhaps Canberra as a surprise entry, but fast forward to September 2024, and the landscape has changed dramatically. Let’s look at the top five cities and examine how they’ve fared over the past year.

1. Sydney: Consistent Leader

Sydney continues to hold the top spot in the national property market, and it’s easy to see why. In September 2023, the median property value in Sydney was $1,098,821. Fast forward to September 2024, and it has risen to $1,188,912, maintaining its position as the most expensive city in Australia for real estate. The combination of limited land availability, strong demand, and Sydney’s status as a global city has kept its property market resilient, even in the face of economic shifts and rising interest rates. And they’re not making any more harbour!

2. Brisbane: The Rising Star

Brisbane has shown remarkable growth over the past year, jumping from fourth spot in 2023 to second in 2024. The median property value in Brisbane was $747,626 in September 2023 and has surged to $881,091 in September 2024. This substantial rise can be attributed to Brisbane’s increasing popularity as a lifestyle destination, home of tech darlings with a unique startup ecosystem as well as the city’s relatively affordable housing compared to Sydney and Melbourne. With Queensland’s population growth and the upcoming 2032 Olympics driving infrastructure development, Brisbane is poised to continue its upward trajectory. And the weather’s not to be sneezed at either.

3. Canberra: Steady Climb

The nation’s capital, Canberra, moved down from second to third place over the past year. In September 2023, the median property value stood at $830,375, increasing to $844,882 in 2024. Although this growth may seem modest compared to Brisbane, Canberra’s market has remained relatively steady due to its stable government employment base and allied services and industries meaning consistent demand for quality housing. Canberra’s appeal lies in its quality of life and family-friendly environment, keeping its property market buoyant.

4. Adelaide: The Hidden Gem

Adelaide’s rise from eighth to fourth place is one of the most notable changes in the rankings. The city’s median property value was $682,642 in September 2023 and has jumped to $802,075 in September 2024. Adelaide’s affordability compared to other capital cities, combined with its thriving local economy and lifestyle appeal, making it attractive to international students, investors and owner occupiers alike, has resulted in increasing numbers of keen buyers. The city’s relatively low cost of living and growing reputation as a tech and innovation hub are likely to continue attracting investment.

5. Perth: The Comeback City

Perth rounds out the top five, having moved up from seventh place in 2023 to fifth in 2024. Perth’s median property value has increased from $607,083 in 2023 to $797,184 in 2024. The city’s economic reliance on mining and resources has always been a factor in its property market, and as commodity prices fluctuate, so do property values. However, Perth is an attractive destination for investors looking for long-term growth, particularly as the city continues to develop its infrastructure and diversify its economy away from such heavy reliance on extractive industries.

Conclusion

The 2024 rankings reveal that Australia’s property market remains in flux, with cities like Brisbane and Adelaide gaining significant ground. While Sydney continues to lead the pack, the rise of these secondary cities shows that real estate opportunities extend beyond the traditional powerhouses. For investors and homebuyers alike, keeping an eye on these emerging markets could offer exciting opportunities in the years to come.