One of the biggest struggles for buyers at the start of their home ownership journey is the challenge of saving a large enough deposit for their purchase. Over the past couple of years this has been compounded by rapidly increasing prices – it seems that rising prices were way outpacing the speed with which buyers could save to satisfy deposit requirements. Of course, increasing rents just compounds the issue.

On July 1, 2022 the National Housing Finance and Investment Corporation (NHFIC) announced an increase in the number of places for the Home Guarantee Scheme. The Home Guarantee Scheme is administered by NHFIC and comprises the First Home Guarantee and the Family Home Guarantee.

The Home Guarantee Scheme comprises the First Home Guarantee (FHBG), previously known as the First Home Loan Deposit Scheme, and the Family Home Guarantee (FHG). The FHG is for single parents.

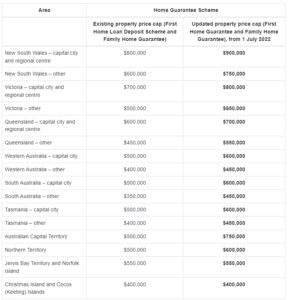

Previously 10,000 places were available each year through the First Home Guarantee and this will now increase to 35,000. This scheme allows purchasers to buy with as low as a 5% deposit. Also available is 5,000 new places for single parents with dependents under the Family Home Guarantee allowing recipients to buy with a deposit of 2% or less. Price caps are applied to home purchase prices and these have also been increased which means the Scheme will now be applicable to more purchase transactions.

In South Australia the existing price cap of $500,000 for capital city purchases will increase to $600,000 while for areas other than capital city, the increase will move from $350,000 to $450,000 making a regional or rural move very attractive.

This is all great news for first home buyers who have been struggling to enter the housing market in South Australia. The increased number of places will mean that more purchasers will have access to the assistance they need to make their home ownership dream a reality.