The Spring sale season has now come to an end. For the 10 years prior to the 2020 Financial Year, annual property transfers recorded in South Australia hovered at an average of around 46,000 transactions. Land Services SA registers a transfer just after a property settles. For the 2021 and 2022 Financial Years that average jumped to more than 62,000 and for the twelve-month period ending November 2022, there were 61,493 transfers recorded. While it will be some time before we know the final number for FY 2023, indications are that we will return to a more normalised figure for this current financial year given what we have seen so far.

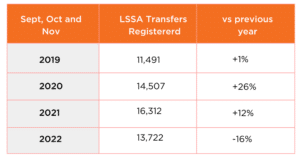

We can see the slowing of transaction numbers looking at the collective three month of September, October and November for the last four years. Things really took off in 2020 and the growth in transactions continued in 2021 but things have certainly slowed across that three-month period in 2022.

The past two years have taught us something about the patterns in real estate cycles in South Australia – there are no patterns in real estate cycles in South Australia. The market has been impacted significantly by COVID-19 and several trends have emerged such as the move to work from home, to exit large cities, to find a tree or sea change, more cashed up buyers than usual because of the restrictions on travel and the re-emergence of cocooning as a trend. This begs the question – what is normal anymore and is it all COVID driven or is there something else going on? Let’s take a look at cocooning.

Cocooning

I first heard the term cocooning during the 2009 financial crisis though it was initially coined in consumer behaviour literature back in the 1980’s. In 2009, as people reacted to the global financial crisis and began to tighten their belts, they stayed home more to save money; choosing to entertain and make fun there as opposed to going out. As a consequence, households began making small improvements to accommodate that behaviour shift – think integrated sound systems, big screen TVs, home theatres, outdoor kitchens, firepits and the like.

COVID saw a re-emergence of the cocooning concept but this time it came about more by force or fear than by choice. At times, it felt plain dangerous to leave home and at others it wasn’t permitted to do so. This left everyone not only stuck at home but with extended time to consider what they liked about their home, how their needs were changing (e.g., a study as a must-have, rather than a convenient option) and what could be improved. And if improvement wasn’t an option, a sale and purchase was on the cards.

With limited travel opportunities and repeated travel plan cancelations and disappointments, people also started looking for other ways to satisfy the need to reward themselves. Rather than traveling within Australia and overseas, they looked closer to home – in fact, right inside their homes. Builders were never busier as homeowners began minor and major additions and renovations, Bunnings was absolutely busting and real estate agents were run off their feet as first home buyers found they were able to save that deposit after all (let’s face it, there was nothing else to spend their money on), current owners made the decision to upscale (not necessarily upsize) and those for whom an investment property was previously a bit of a dream, they suddenly found they had some spare cash to devote to creating another income and capital growth stream.

Upscaling and generational expectations of home

Whatever the drivers, the impact of upscaling is a shortened ownership cycle because of increasing property turnover. It remains to be seen whether this is permanent, but things certainly change as the expectations of each generation adjust to new needs and norms.

Consider those married earlier last century. They tended to stay in their first home for all of their active life, keeping it well-painted and their gardens productive and pretty. As families grew, they simply found new and inventive ways to squeeze them in.

The generation that moved into their first home in the 60’s and 70’s was the cohort that discovered the rumpus room; the precursor to the combined kitchen/family room. They would add bedrooms and bathrooms as the family expanded and maybe even an aboveground pool.

The families that formed in the 90’s and later had regular kitchen refits, updated their bathrooms and expanded living and bedroom spaces as required by growing families. They demanded indoor and outdoor entertaining areas, inground pools and undertook major renovations or even demolition and rebuilds.

Our expectations have matured over time and our demands are much more sophisticated than the generations before us. Upscaling will continue as will cocooning and our homes will have vastly improved living, working and entertaining spaces compared with the generations before us.

Values and transaction numbers

What does it all mean for property values and transactions? We expect to see SA residential property experience prices softening after some spectacular growth over the past couple of years, but it will be a softening rather than a dive – and we’ve seen a little of it already. For the twelve months to November 2022, values in Greater Adelaide are up 13.4% (the only Australian city to have experienced double-digit growth over that period) and while last quarter we saw a small -0.8% drop in values; this is very moderate compared with Sydney and Melbourne value reductions over the same period. For the 12 months to November prices in Sydney and Melbourne contracted -10.6% and -7% respectively.

From the COVID drop through to the peak median price month of July 22, Adelaide values increased 44.7% – the highest of any capital city market. Further moderate value correction is expected and will be affected by interest rate increases and high inflation which will cause stress for owners and purchasers. These pressing factors will likely continue into the new year however, the SA price correction is unlikely to be of the quantum that we have seen on the eastern seaboard this calendar year. The number of property transfers in SA will stabilise to a new normal that will be lower than it has been for the past three years but higher than the three years before that.

Will we continue to upscale? Probably – the only fly in that ointment would be a recession which thankfully for now, doesn’t seem very likely. But we’ve experienced many things in recent years that didn’t seem likely…