Updates to land tax in SA.

Background of the changes.

There will be a number of changes to land tax in South Australia from 1 July 2020.

Initially the proposed changes were announced by the Government as part of the 2019-20 State Budget handed down in the 18th of June 2019.

After many iterations and negotiations with the Greens and independent members of parliament on the 28th of November 2019, the Land Tax (Miscellaneous) Amendment Bill 2019 was passed.

The legislation will take effect from 1 July 2020 (i.e. land held at midnight on 30 June 2020).

Changes that will mean less Land Tax payable

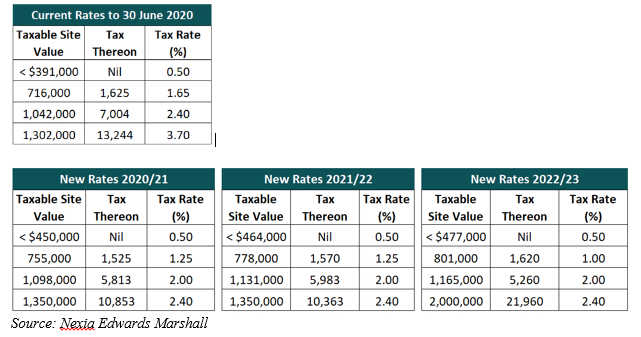

- Reduction in the top marginal land tax rate from 3.7% to 2.4%

- Increase in the top marginal threshold from $1.3M to $2M by 2023

- Increase in the tax-free threshold to $450k in 2020/21, $464k in 2021/22 and $477k in 2022/23

- New threshold introduced between $1.1M – $2M taxed at 2%, rather than 2.4%

- A $25M transition fund will assist provide partial relief to eligible individual taxpayers and company groups (who qualify) for three years

Source: Nexia Edwards Marshall

Changes that will mean more Land Tax payable

- New aggregation measures to include the taxable value of all land ownerships held by an owner based on their interest in every piece of land, rather than only aggregating properties held in the same ownership structure

- Provisions introduced to allow two or more related companies to be grouped for land tax

- Trust surcharge rates will be imposed on certain trusts unless the trust is exempt &/ or can nominate a designated beneficiary

Source: Nexia Edwards Marshall

The “Revaluation Initiative”

The Valuer-General’s office has recently been undertaking a revaluation initiative where they are hoping to provide more accurate valuations for properties across all of SA, this is happening over a 3 year period and is about 18 months in. The progression of these changes are largely geographic with the bulk of inner metro areas to form part of the second cycle in FY21, other metro and regional areas will follow.

The likelihood is that the site and capital values will only increase through this initiative making the Land Tax changes potentially hurt a little more for some property owners.

What do these changes mean to property owners?

- If you only own a single parcel of taxable land or multiple parcels which are already aggregated, you could potentially benefit from the new lower rates and higher thresholds, particularly if the aggregated value of your land holding(s) is significant.

- If you own multiple parcels of taxable land through different ownership structures and entities, then you will need to review your current land holding position as you could potentially have an increased annual land tax liability.

Source: Nexia Edwards Marshall

Rates and thresholds

Need further assistance?

For all queries during business hours, please contact us on 8366 7900 or email info@eckermannconveyancers.com

We also have an out-of-hours communication service, Eckermann Assist, for all Contract, Form 1 or conveyancing queries. This service is available Monday to Friday between the hours of 7.00am – 9.00pm and on weekends and public holidays between 9.00am – 5.00pm.

Whether you are an agent or another real estate professional, vendor or purchaser, a current client or have never before engaged a conveyancer, we are available to answer your queries. To access Eckermann Assist simply phone 8235 3944 or email assist@eckermanns.com.au. This service is available Monday to Friday between the hours of 7.00am – 9.00pm and on weekends and public holidays between 9.00am – 5.00pm.