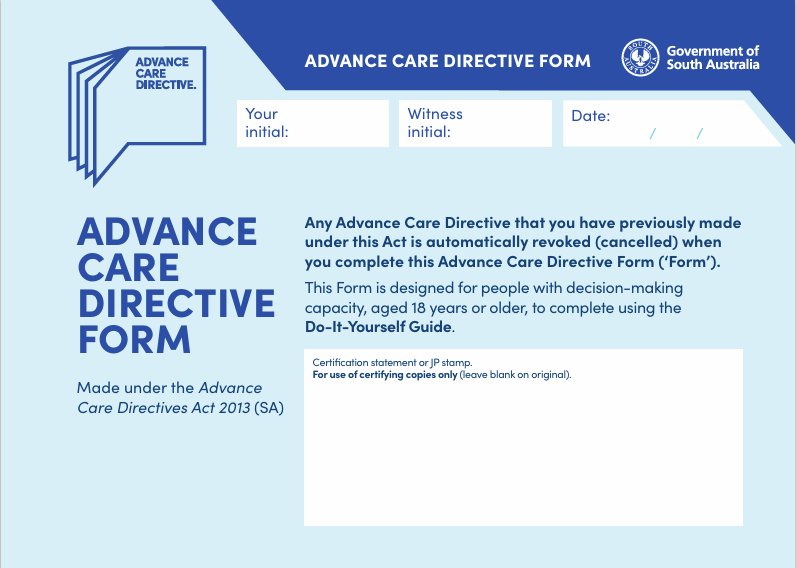

South Australia’s Advance Care Directive (‘ACD’) allows you to appoint people to make medical decisions on your behalf if you are unable to make decisions yourself. It also allows you to record your wishes and values and refusals of health care, so that the people you appoint will be guided in their decision making. We … Continued